EU Corporate Sustainability Reporting Directive (CSRD)

The EU Corporate Sustainability Reporting Directive (CSRD) expands and strengthens sustainability disclosure requirements for companies operating in Europe. It mandates transparency, consistency, and comparability in ESG reporting to improve corporate accountability and align with EU sustainability goals.

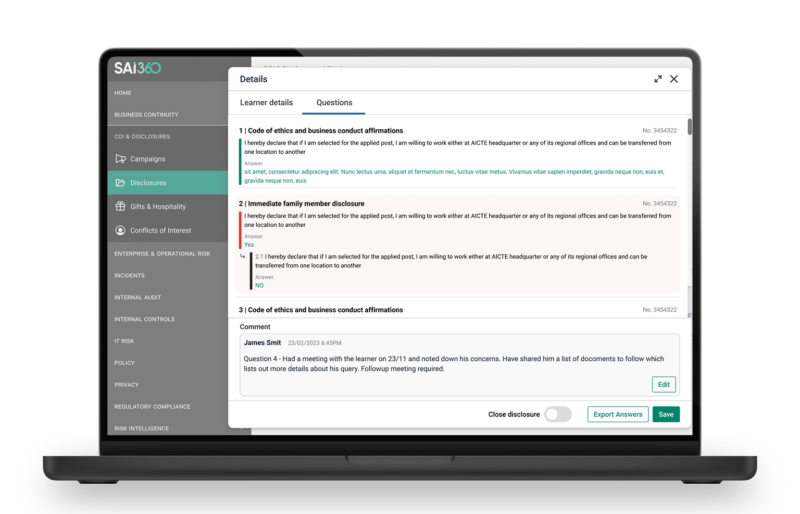

SAI360 helps organizations meet CSRD requirements by delivering a centralized, dynamic platform for ESG and sustainability governance. From mapping ESG risks to regulatory frameworks, to automating data collection, performance tracking, and assurance workflows, our solution is designed to reduce complexity and boost readiness.

Whether you’re building your sustainability reporting from the ground up or optimizing an established ESG program, SAI360 empowers your teams to stay ahead of regulation and stakeholder expectations.

Modules that Power the Solution

FAQs

Let Us Help

SAI360 enables you to make agile decisions using up-to-the-minute dashboards for key metrics to: